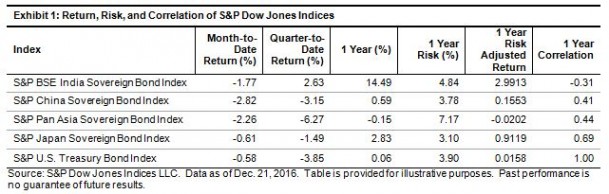

The U.S. Federal Reserve recently announced a rate hike of 0.25%, while indicating more rate hikes are likely in 2017. As of Dec. 21, 2016, the S&P U.S. Treasury Bond Index had lost 0.58% for the month, bringing its total return to 0.06% YTD, while its yield widened 27 bps to 1.75% in the same period.

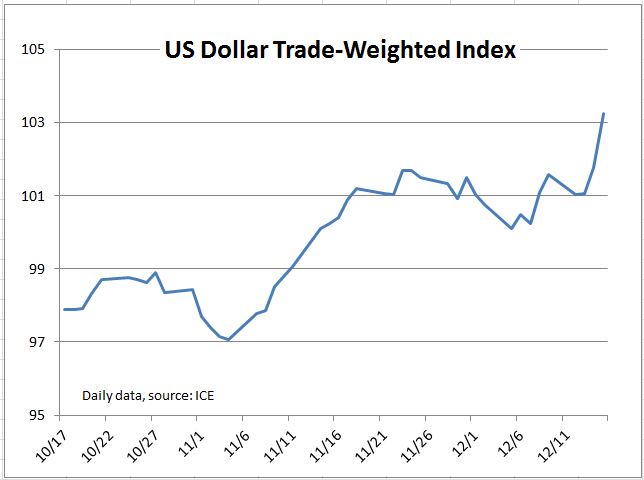

On the other hand, the S&P Pan Asia Sovereign Bond Index, which seeks to track the performance of local-currency-denominated sovereign bonds in 10 countries, continued its plunge this quarter, dropping 2.26% for the month and 0.15% YTD as of Dec. 21, 2016. Asian bond market performance varied, as countries have adopted different monetary policies. Arguably, some sell-offs may be triggered by the strengthening of the U.S. dollar, but the historical correlation of the S&P Pan Asia Sovereign Bond Index with the S&P U.S. Treasury Bond Index had been low, in the range of 0.34-0.44.

The correlations of China and India with the U.S. were much lower, largely because their bond performances were mainly driven by their central banks and domestic fundamentals. The sovereign bonds from some Asian countries like Singapore and South Korea had higher correlations with U.S. Treasury bonds, but they were of smaller significance within the index due to their relatively smaller market values.

The Bank of Japan maintained its key policies—a negative interest rate at -0.1% and the use of asset purchase programs to boost the economy. The S&P Japan Sovereign Bond Index dropped 0.61% for the month and 1.49% YTD as of Dec. 21, 2016, while its yield tightened by 20 bps to 0.05%, after spending eight months in negative-yield territory. Interestingly, despite opposite movement in interest rates, the correlation of the S&P Japan Sovereign Bond Index and S&P U.S. Treasury Bond Index increased to 0.69 in the past year.