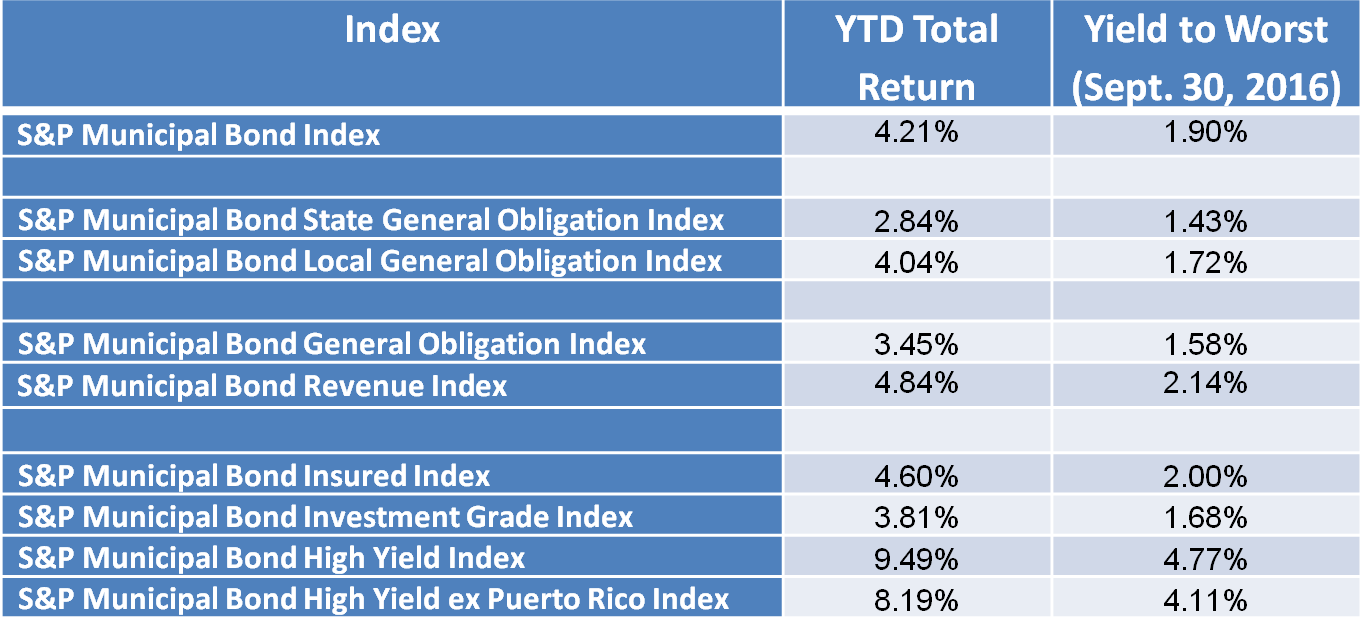

The S&P Municipal Bond Index has recorded a 4.21% year-to-date total return for the first three quarters of 2016 lagging the taxable corporate bond market returns of nearly 9% as tracked by the S&P 500 Bond Index. Some segments of the municipal bond market are contributing more than others:

- Local general obligation bonds have out performed state general obligation bonds by 120bps.

- Revenue bonds have out performed general obligation bonds by 139bps.

- Insured municipal bonds have out performed investment grade bonds by 79bps.

- The S&P Municipal Bond Puerto Rico Index has returned over 13.4% year-to-date pushing the S&P Municipal Bond High Yield Index to out perform the S&P Municipal Bond High Yield ex-Puerto Rico Index by 130bps.

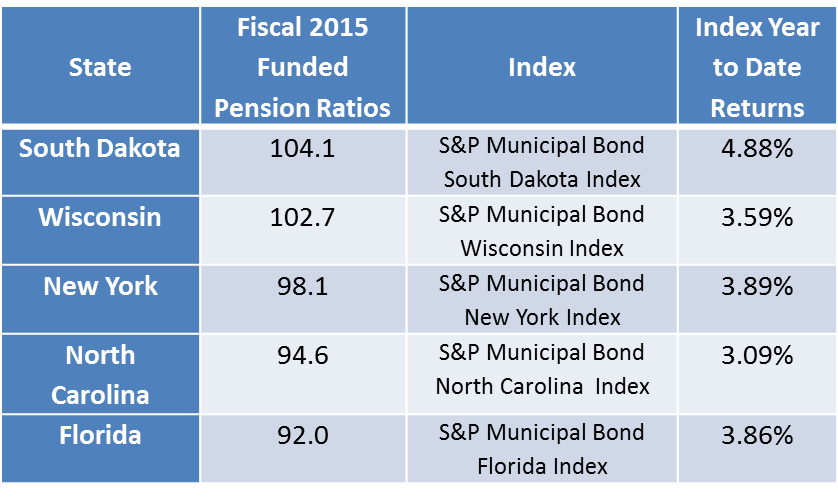

Table 1) Select municipal bond indices, their year-to-date returns and yields as of September 30th 2016