In my blog “Introducing the CBLO Rate,” we discussed what the collateralized borrowing and lending obligations (CBLO) rate is and how the S&P BSE Liquid Rate Index would be useful for market participants. In this post, let’s discuss the history of the CBLO rate and nature of CBLO rate movement.

The repo rate is the rate at which banks borrow from the Reserve Bank of India (RBI), and the reverse repo rate is the rate at which banks deposit their excess cash with the RBI; both are policy rates that move only when the RBI decides to change them during its periodic monetary policy review. On the other hand, the CBLO rate is completely market driven and changes depending on the short-term liquidity situation in the market.

Generally, the CBLO rate should range between the repo and reverse repo rates, otherwise it would create an arbitrage opportunity for banks, which are active in both markets (repo and CBLO). If the CBLO rate were to move out of the band of repo and reverse repo rates, banks could borrow from the cheaper market and lend in the more expensive market. For example, if the CBLO rate is hovering around 5%, which is lower than the reverse repo rate of 6%, banks could profit by borrowing at the CBLO rate and lending at the reverse repo rate (or depositing the same amount with the RBI), earning a risk-free profit of 1%.

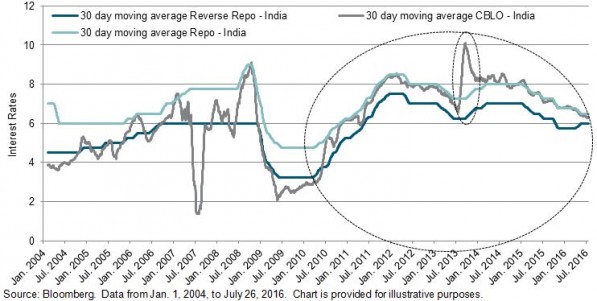

Exhibit 1 illustrates the 30-day moving average CBLO rate, repo rate, and reverse repo rate. The 30-day moving average is used to avoid outlier numbers and get a meaningful picture of all three rates. From 2004 through the first half of 2009, it appears that the CBLO rate was more volatile and frequently outside of the repo rate and reverse repo rate band. However, since 2010, the CBLO rate tended to be in between the repo rate and reverse repo rate, except during the second half of 2013 and first half of 2014. Starting in November 2009, the RBI asked banks to set aside 5% of funds borrowed under the CBLO as a cash reserve ratio in order to stop discourage arbitrage opportunities between the two markets.

Exhibit 1: 30-Day Moving Average

While the CBLO market is gaining popularity among various money market instruments, at present it is only accessible to institutions such as banks, financial institutions, corporates, etc., and it is yet to become available for smaller investors. Another problem with the CBLO is that the treasury manager has to roll over deposits every day unless he finds a borrower or a lender for the desired maturity in the CBLO market. It is worth reiterating that the majority of liquidity is in overnight tenor, which means other tenor rates may have a liquidity premium as well.

One possible solution for this could be an ETF based on the S&P BSE Liquid Rate Index, an index that seeks to track the weighted-average CBLO rate. An ETF fund manager would roll over the deposits each day to earn the daily overnight CBLO rate. This would also open the CBLO up to smaller investors as they buy ETFs to get exposure in the CBLO market. This could effectively help increase liquidity in the CBLO market further.

While we have a liquid overnight CBLO market, it will be interesting to see how the term segment of the CBLO market evolves in the future.

The posts on this blog are opinions, not advice. Please read our Disclaimers.