After yesterday’s record close for the S&P 500, memories of last month’s Brexit panic seem far away. (In fact the U.K. referendum to leave the European Union took place only 19 days ago as of this writing.) In the immediate aftermath of the referendum, global markets fell sharply, while low volatility indices mitigated the impact of the decline. The crisis, if we may call it that, was short-lived. The U.K. referendum took place on a Thursday, markets fell for the next two trading days, and then bottomed on Monday June 27.

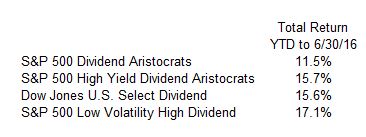

Low volatility indices attenuate the returns of their parents in both directions. They typically decline less when the market goes down, but rise less when the market goes up. Since June 27, in fact, they have lagged their cap-weighted counterparts, as illustrated below for the S&P 500:

From June 27 to July 11, the S&P 500’s total return was 6.9%, well ahead of S&P 500 Low Vol’s 5.5%. Notice, though, that since the beginning of June, Low Vol has significantly outperformed the S&P 500. Even though it lags on the upside, the cushion that Low Vol provides on the downside can make for attractive compound returns over time.

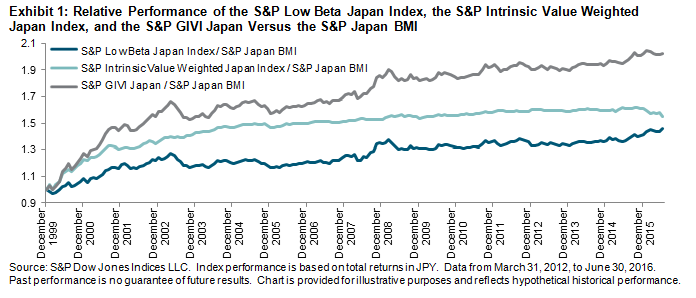

This effect is not limited to large-cap U.S. stocks:

Even with the market at all-time highs, low volatility’s performance continues to be attractive.

The primary determinant of the relative performance of low volatility is the return pattern of its parent index. If the S&P 500 goes up 30% next year, S&P 500 Low Vol is highly likely to lag far behind, and the opposite is true if the market declines significantly. In that sense, predicting the relative performance of Low Vol is tantamount to predicting the direction of the market as a whole. Some fortunate souls may have the key to that puzzle, but we are not among them.

What we can say is that low volatility’s performance is typically characterized by protection from the worst of downside moves and participation in market rallies. Neither the protection nor the participation are perfect — but for the investor who’s willing to forgo some upside in exchange for a smoother downside, low volatility can provide a congenial pattern of returns.

The posts on this blog are opinions, not advice. Please read our Disclaimers.