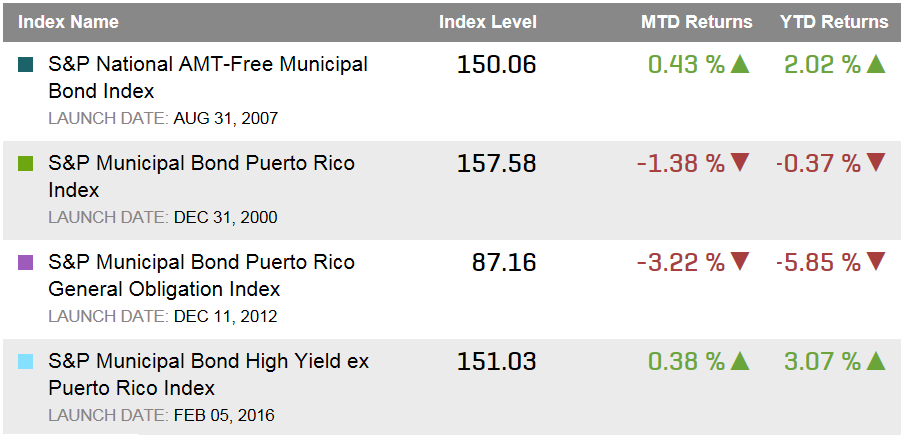

The governor of Puerto Rico has moved forward with a bill to suspend debt payments while looking for Washington to help. The muni market reacted dragging the General Obligation bonds down further. The S&P Municipal Bond Puerto Rico General Obligation Index has dropped over 3% in April so far and over 5.8% year-to-date.

Municipal high yields bonds tracked in the S&P Municipal Bond High Yield Index have risen over 2.1% year-to-date, the same index excluding Puerto Rico bonds is up over 3% year-to-date.

Table 1) Selected municipal bond indices and their returns: