The world seems to be awash with schisms these days. There are always great divides in politics, but this year they seem greater than usual. However, the schisms and splits in the financial world matter more for now: at the Fed, in differing growth rates among the US, Europe and China, and between stocks and oil.

The Fed appears to be divided between the hawks and doves when it comes to raising interest rates. Two speeches last week establish the contrasting positions. Fed Vice Chair Stanley Fischer suggested that inflation may be about to increase while affirming his belief that the Phillips Curve – the inverse relation between unemployment and inflation – is still is worth watching after six years of declining unemployment and flat to falling inflation. The same day Fed Governor Lael Brainard noted that economic weakness abroad poses a risk to the US, suggesting the Fed might be better off not raising interest rates this year. This schism should assure no change in the Fed funds target rate on Wednesday when the FOMC meeting issues its statement.

If there is such a thing as a three way schism, it is among growth in the world’s major economies. The US managed 1.9% real GDP growth in 2015, more than double the amount experienced in the Eurozone (0.4%), the UK (0.5%) or Japan (0.8%), but not even close to China’s 6.9% pace. Even though China’s numbers are expected to slip slightly, this wide spread means that national economic policies may be working against one-another rather than together. Expect conflicting arguments about managing currency exchange rates or losing jobs overseas. The US dollar rose about 15% against major world currencies from mid-2014 to mid-2015; putting pressure on US exports while helping other nations’ export activity.

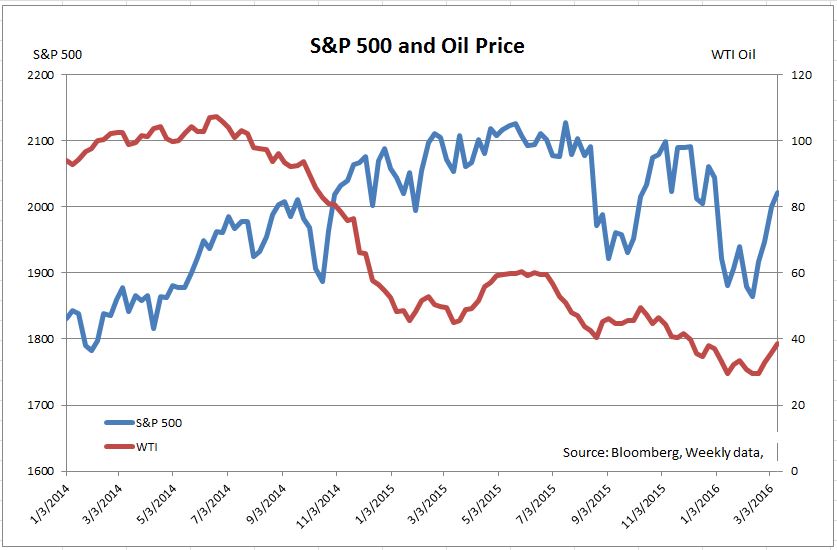

The relative behavior of stocks and the price of oil are another puzzle, although some recent analysis may hold an answer. The chart shows the prices of the S&P 500 and WTI oil since the beginning of 2014. At first glance the two series move in opposite directions. Since cheap oil is favorable for most US companies one would expect lower oil prices to be a positive factor for the stock market. However, this pattern reversed for a few weeks last summer and again since the start of 2016. Two factors that would affect both oil prices and stocks the same way may be behind these reversals. Signs of increasing or decreasing global demand would cause both series to move together, overcoming the impact of lower oil costs. A second factor would be risk-on/risk-off which would push speculators out of both the oil and stock market. A detailed econometric analysis of these factors is offered by Ben Bernanke.