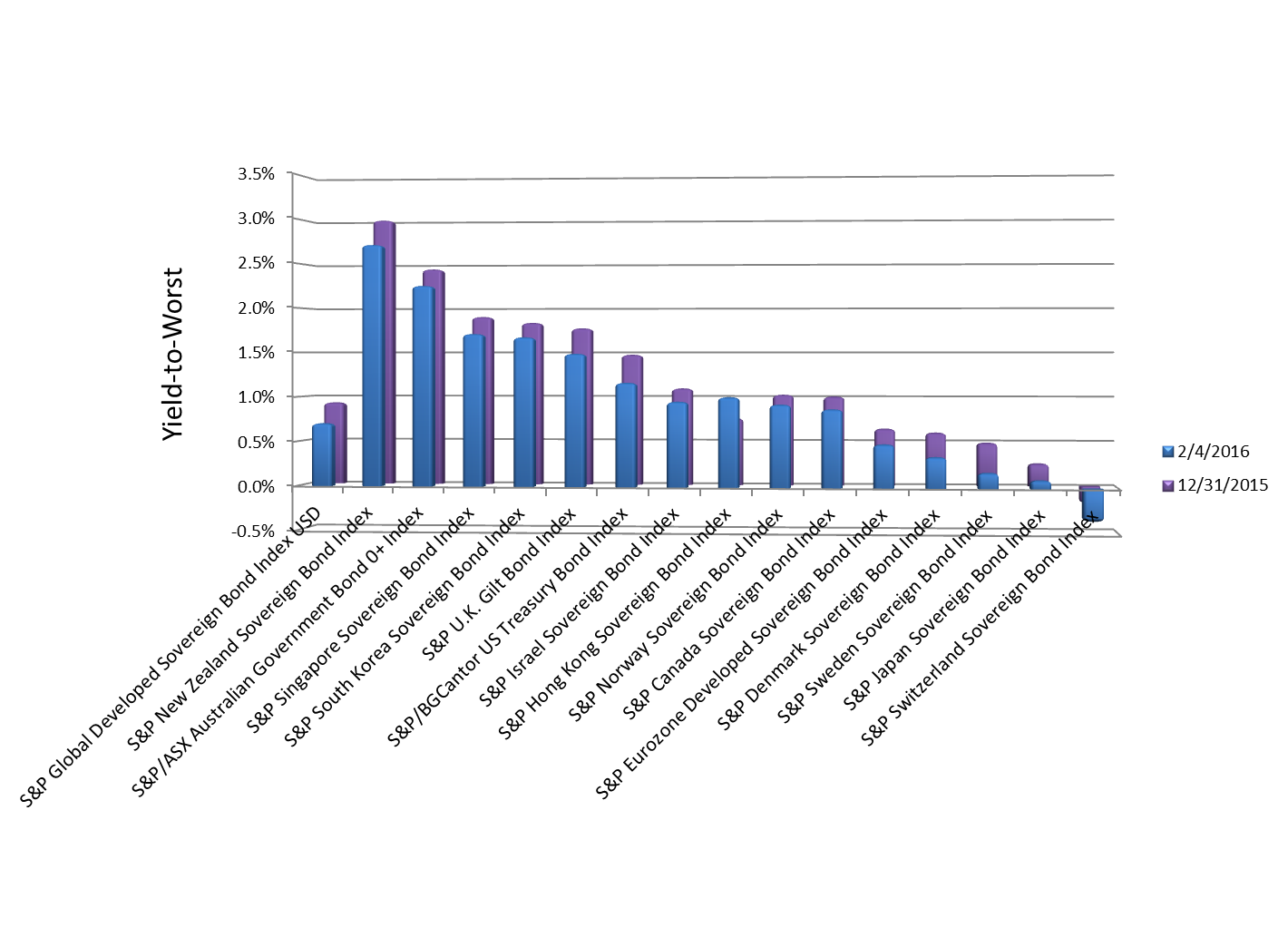

Global yields are lower year-to-date in all developed countries except Hong Kong, as measured by the S&P Global Developed Sovereign Bond Index.

Weak economic growth, low inflation, and concern over the situation in the Middle East have led many to invest in safer assets.

The U.S. market took note of the slowing growth, both domestically and internationally, as the S&P/BGCantor Current 10-Year U.S. Treasury Index’s yield-to-worst moved 13 bps lower between the week of Jan. 28, 2016, and Feb. 4, 2016.

Japan’s policy makers switched to negative interest rates in an attempt to keep the economy from going deeper into the malaise that has weighed down its economy for the last two decades.

The European Central Bank is in a sub-zero interest rate environment as well.

The Bank of England board members voted unanimously to hold rates at 0.5%.

The Swedish Riksbank will meet Feb. 11, 2016, possibly to announce even lower interest rates, after adopting negative interest rates a year ago.

Oil prices, as measured by WTI crude oil futures, have moved down 18% since the beginning of the year to USD 31, as of Feb. 4, 2016.

Exhibit 1: Countries of the S&P Global Developed Sovereign Bond Index

Source: S&P Dow Jones Indices LLC. Data as of Feb. 4, 2016. Chart is provided for Illustrative purposes.

The posts on this blog are opinions, not advice. Please read our Disclaimers.