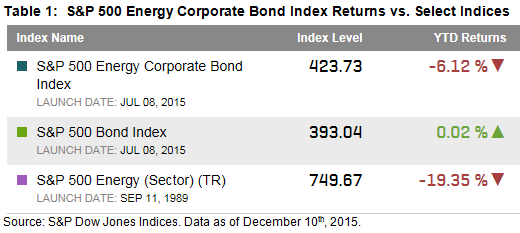

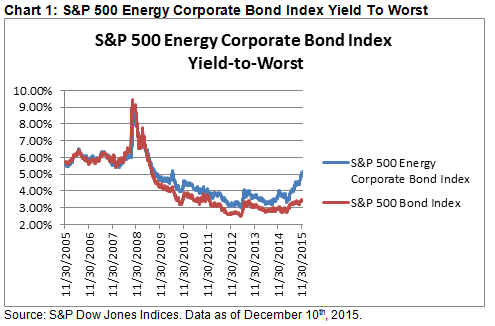

Some high yield bond funds are reeling with the impact of the price of oil on energy related companies with debt. The S&P 500 Energy Corporate Bond Index, tracking over $255billion in debt, is down over 6% year-to-date while the overall S&P 500 Bond Index remains in positive territory. Energy bonds have been less volatile than the stock of these companies but a 6% drop is painful for bond investors.

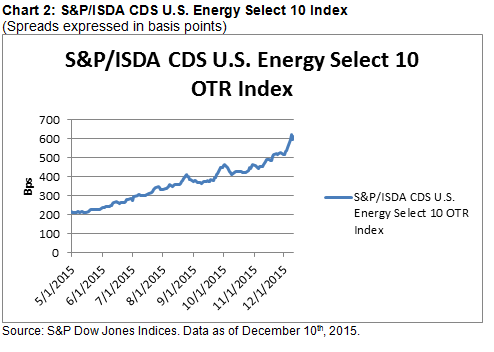

More telling is how the credit markets are viewing the cost of buying default protection on the debt of energy related companies. The cost of buying default protection has risen by 185% since May 1st, 2015 indicating the credit markets are expecting more distress in the sector over the near term. Based on the index the cost per $100,000 of protection on May 1, 2015 was $2,130 and the cost per $100,000 of protection on December 10th was $6,080.

The posts on this blog are opinions, not advice. Please read our Disclaimers.