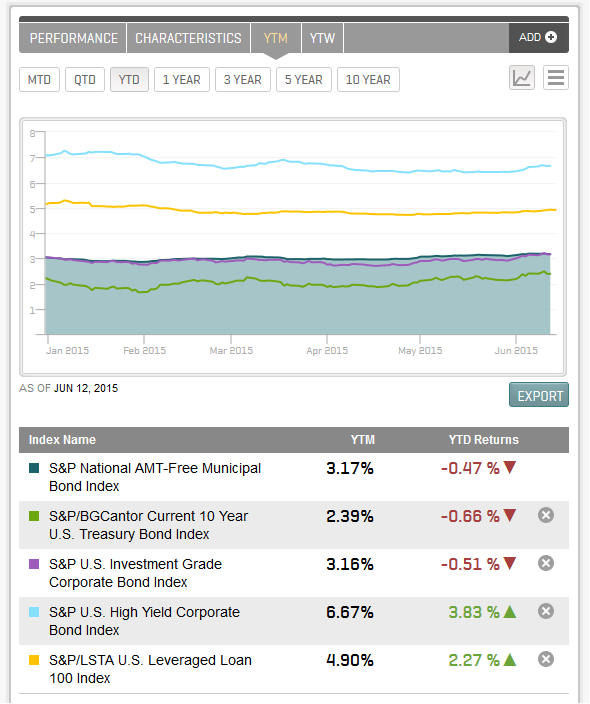

The yield-to-worst of the S&P U.S. Investment Grade Corporate Bond Index was relatively flat for the week, closing Friday, June 12, 2015, at a 3.15%. For the previous week, Lipper data reported positive flows into investment-grade corporate bonds (June 3, 2015), which appeared to be buying on the dip, as the index moved from a yield of 2.89% on May 29, 2015, to the June 3, 2015, level of 3.10%. The move into investment-grade corporate bonds may be opportunistic buying that resulted from the USD 2.6 billion of outflow in the high-yield market during the week of June 10, 2015.1 Current performance of the index is down, with the index having returned -1.60% month to date (MTD) and -0.51% year to date (YTD).

When comparing municipal bonds to investment-grade corporate bonds, the S&P National AMT-Free Municipal Bond Index has a yield-to-maturity of 3.17%, compared with the S&P U.S. Investment Grade Corporate Bond Index’s 3.16% pre-tax. This traditionally retail-investor-heavy sector has a tax equivalent yield of 4.87%. Coincidentally, the municipal bond index has only lost 0.47% both MTD and YTD.

According to the recent Financial Times article, “US junk bond rout entices asset managers”, market participants continue to require higher yields from speculative-grade investments in the face of outflows. Professional investors tend to see the rise in yields as a potential buying opportunity for this sector. The yield of the S&P U.S. High Yield Corporate Bond Index has moved from 6.11% at the beginning of the month to its current level of 6.46%. The index has returned -0.94% MTD and 3.83% YTD. Similar to high-yield bonds, speculative-grade senior loans, as measured by the S&P/LSTA U.S. Leveraged Loan 100 Index, have returned -0.36% MTD and 2.27% YTD.

Market participants’ attention will likely be on this week’s Federal Open Market Committee (FOMC) rate decision scheduled for Wednesday, June 17, 2015. The current range of 0.00% to 0.25% is expected according to surveys. Many investors are looking to September rather than this week’s meeting for any kind of decision. The week before saw the yield of the S&P/BGCantor Current 10 Year U.S. Treasury Index close two bps tighter at 2.39%, after a 27-basis-point widening the week before. The index has lost 2.23% MTD and is down 0.66% YTD. The S&P U.S. TIPS Index has not faired any better, as the index has returned -1.36% MTD and -0.40% YTD. The May CPI level is due to be announced on Thursday, June 18, 2015, with 0.1% expected after having had levels of zero or slightly below since the start of the year.

1 Financial Times, US junk bond rout entices asset managers, June 15, 2015. (http://www.ft.com/intl/cms/s/0/f452f81e-129e-11e5-8cd7-00144feabdc0.html#axzz3d90M5lC9)