The China PMI continued to show deterioration while the headline PMIs for other countries like South Korea, Taiwan and Indonesia also ticked down. The market is expecting more easing to come in order to support the growth.

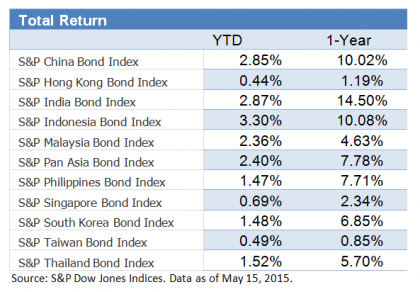

As of May 15, 2015, the S&P Pan Asia Bond Index rose 0.10% this month, bringing the year-to-date (YTD) total return to 2.40%, yet the individual market showed mixed performance. The S&P Indonesia Bond Index continued the slide and fell another 0.79% in May. Please see exhibit 1 for YTD and 1-Year total return performance.

On the other hand, China is the best performer of the month. The S&P China Bond Index rose 0.70% MTD and 2.85% YTD, led by the gains in the corporate bonds. On the back of the strong Chinese equities rally, the S&P China Convertible Bond Index jumped 11.4% YTD. The Chinese offshore RMB bond market, represented by the S&P/DB ORBIT Index also went up 1.94% YTD. Though the index’s yield tightened by 33bps to 4.37%, it offers yield pick-up over the onshore bond market.

Exhibit 1: Total Return Performance of the S&P Pan Asia Bond Index

The posts on this blog are opinions, not advice. Please read our Disclaimers.