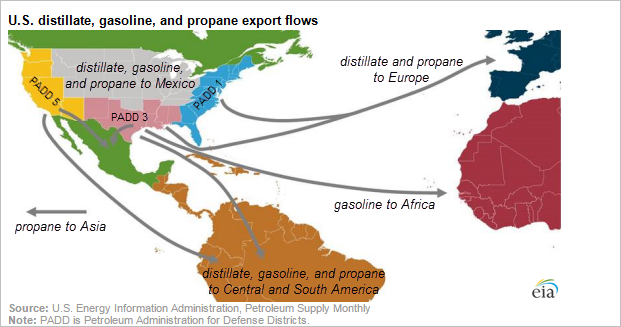

The Brent crude oil and unleaded gasoline price difference, or “crack spread“, is a widely followed relationship to measure the value extracted along the chain of producing oil to refining it that can serve as a proxy for profit margins. The EIA (Energy Information Agency) reported global gasoline supply and demand patterns have been evolving with demand greater than supply in Asia, Latin America, and the Middle East. In the U.S., the production of gasoline has been outpacing the demand, resulting in increasing exports of U.S. gasoline into the global market. Despite the relative cheapness of U.S. gasoline to the international markets from the fundamentals, the transportability has allowed benchmarks to measure the global seasonality.

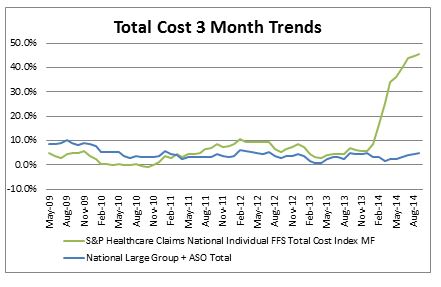

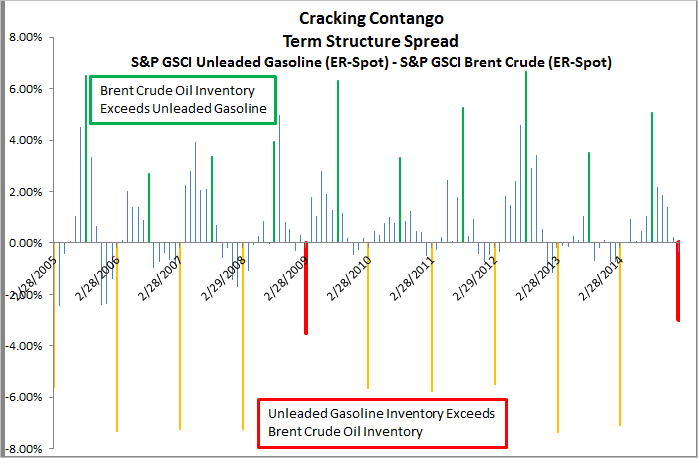

In indexing, the difference in roll yields can be measured to theoretically reflect the relationship between excess and shortage in the oil and gas markets since it is the storage markets that drive the shape of the curves. There is a historically wide roll spread between unleaded gasoline and brent crude oil, seasonally in each February, where the excess inventory of unleaded gasoline markedly exceeds the excess inventory of brent. What is interesting so far this February is that the spread is the narrowest in six years.

According to the IEA (International Energy Agency), global refining capacity is expected to rise after falling to a six-year low and that global refinery margins will come under renewed pressure. They predict further consolidation in the refining industry, especially in Europe and developed Asia as product markets continue to expand and globalise.

While the excess inventory of brent crude oil is larger at this time than in last February, when brent showed a shortage with a positive roll yield, the excess inventory of unleaded gasoline shown by the roll yield of -3.3% is down half from last year and is seasonally very low. This is illustrated in the graph below:

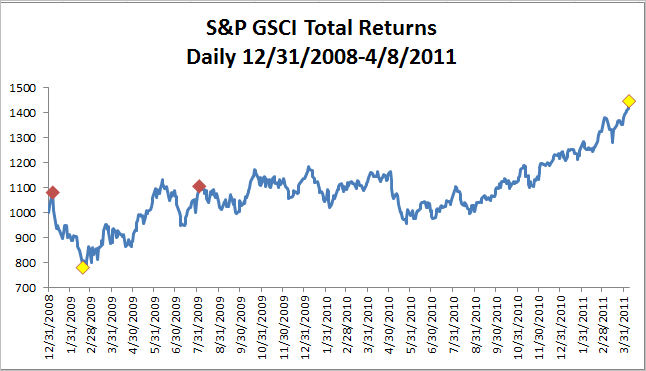

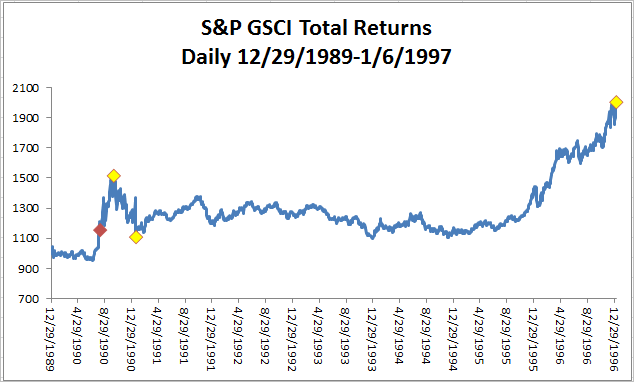

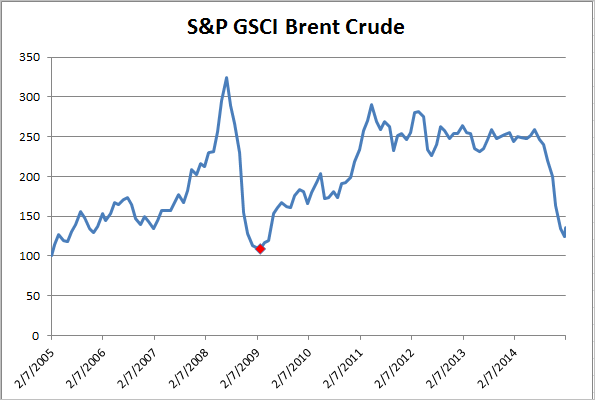

The last time the roll spread was this narrow in February 2009, it marked the bottom of brent. The fundamentals are different this time, driven much more by supply than demand, but the resulting inventory is what might matter most.

The posts on this blog are opinions, not advice. Please read our Disclaimers.