The China offshore renminbi (CNH) bond market has been serving some investors as a gateway to Chinese bonds until the Renminbi Qualified Foreign Institutional Investor (RQFII) program takes off. The size of offshore renminbi market is approaching CNH 800 billion, yet it is relatively small when compared with the CNY 27 trillion onshore bond market, which is tracked by the S&P China Bond Index.

Fundamentally speaking, the CNH and CNY currencies are different; additionally, onshore and offshore Chinese bonds are subject to different interest rate systems. While the spreads of the yield curves have converged over time, some spread differences continue—e.g., 3 bps for a 5-Year Chinese government bond and higher for shorter-maturity bonds.

While China’s onshore market is vast, it is predominately restricted to domestic issuers. On the other hand, many international issuers have tapped into China’s offshore market. For example, there are quasi names such as the IFC, KFW, and Asian Development Bank, and corporate names like Volkswagen, Total, and Caterpillar.

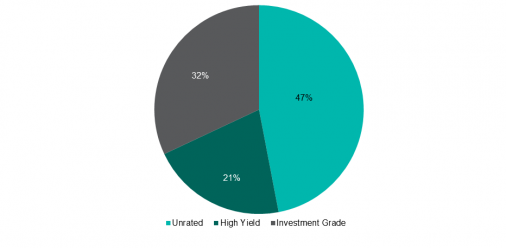

Perhaps a more significant distinction is that 53% of Chinese offshore corporate bonds (by par amount) are rated by international rating agencies, according to the S&P/DB ORBIT Credit Index. Of these, a total of CNY 61 trillion in bonds are rated as investment grade by at least one international rating agency (see Exhibit 1 for the index’s rating profile). Of note, most of China’s onshore bonds are not rated by the international rating agencies.

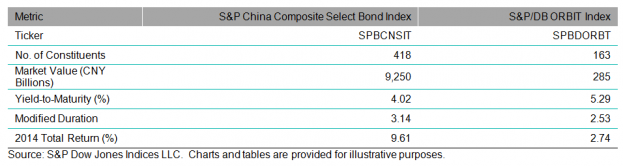

In terms of total return, the onshore market, tracked by the S&P China Composite Select Bond Index, rose 9.61% in 2014, outperforming the offshore market as represented by the S&P/DB ORBIT Index. Exhibit 2 shows a quick comparison of these two indices of investable bonds. Last but not least, liquidity and accessibility are definitely the two key criteria to consider when differentiating China’s onshore and offshore bond markets.

Exhibit 1: The Rating Profile of the S&P/DB ORBIT Credit Index

Exhibit 2: Comparison of Indices

Please click for more information on the S&P China Composite Select Bond Index and the S&P/DB ORBIT Index.

The posts on this blog are opinions, not advice. Please read our Disclaimers.