The Dow Jones Industrial Average is the best-known stock market measure. It has the longest continuous and consistent history of any market average or index and is still going strong today. There is more to the Dow than its long history and the historic record – it is a widely followed guide to the market and a key measure of large blue chip companies in the United States. It is on web sites and television news and is carried every day in the Wall Street Journal and many other newspapers. The Dow was created by the editors of the Wall Street Journal in 1896, a few years after the Journal itself began publishing. Today it is maintained and calculated by S&P Dow Jones Indices and overseen by the Averages Committee; both S&P Dow Jones Indices and the Wall Street Journal are represented on the committee.

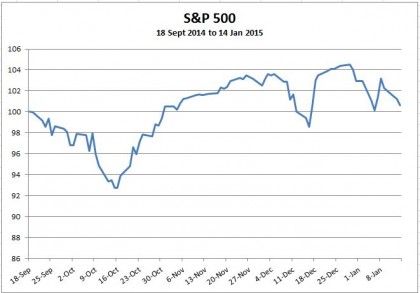

The Dow and the S&P 500 both chronicle the US market and tell similar stories. The chart shows the two indices from April, 1957 to December 2014. The figure starts in 1957 because that is when the S&P 500, a comparative newcomer, expanded from 90 to 500 stocks. The Dow has been 30 stocks since 1928; it began with 12 stocks in 1896. The correlation of monthly returns is 95.4%, confirming the close tracking. In the 692 months from May 1957 to December 2014, the two indices rose, or fell, together in 627 months. The close tracking should not be a surprise. The overall stock market often reacts to large shifts in the economy or changes in Fed policy. Moreover, the 30 stocks in the Dow account for slightly more than one-quarter of the S&P 500’s $19 trillion dollar market value.

Despite the close tracking between the Dow and the S&P 500, the calculation method is different. The Dow is a price weighted index; the calculation is simple enough to do with a pencil and paper in a few minutes. To calculate the Dow, add up the price of each stock and divide by the divisor, currently about 0.155. The divisor is adjusted whenever a stock is added or dropped to prevent the index from jumping or falling when the market didn’t. Corporate actions that affect a stock price, such as a stock split, also lead to a divisor change. The easiest way to think about the Dow is a portfolio which holds one share of each of the 30 stocks. The importance of a stock depends on its price, not on the stock’s total market value. While some argue that this is the wrong way to measure the market, it may actually be close to the way many investors think of their own portfolios. Rarely do investors owning individual stocks try to make their relative size of their holdings track the market capitalization proportions of the companies they own. More often they try to hold either equal dollar amounts or equal numbers of shares in various companies.

Source: www.DJAverages.com, S&P Dow Jones Indices.

Next: Arguing that Apple and Google should be in the Dow, but don’t fit.

The posts on this blog are opinions, not advice. Please read our Disclaimers.