The yield-to-worst of the S&P/BGCantor Current 10 Year U.S. Treasury Bond Index moved down 22 bps last week, to close at 2.09%. This level of yield has not been seen since June 2013. The lowest level seen for this index was 1.4% in July 2012. The index returned 1.49% MTD and 12.33% YTD as of Dec. 12, 2014.

This week, investors will be eyeing any news that comes out of the Fed’s last meeting for the year, which will be wrapping up this Wednesday. Any indication on the timing of a rate increase could have an effect on the markets and its indices.

With the lack of inflation and an unforeseen drop in oil prices, many investors have recently moved out of stock and into the safety of sovereign and investment-grade bonds. The “risk-off” move shows that investors are worried about the weakness in the economies of Europe and Japan, leading to concerns of a drag effect on the U.S. economy as well. With low inflation currently, there is little cause for concern that an increase in inflation would detract from bond investments.

The S&P U.S. Issued Investment Grade Corporate Bond Index has benefitted from the current market environment, as last week’s news turned performance around after a slow start to the month. As of Dec. 12, 2014, the index has returned 0.24% MTD and 7.75% YTD. New issuance has been active and price deals are being issued, such as USD 1 billion in three-year paper issued by both American Honda and Goldman Sachs (floating-rate paper). State Street also issued USD 1 billion, though their deal was for 10-year paper. The newer fixed-rate paper should enter the index at year-end 2014 if all qualifying conditions are met.

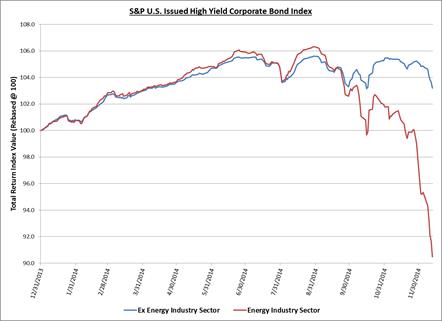

Though still providing yield to portfolios, high-yield bonds have come under fire as the risk-off trades and the drop in oil prices have negatively affected the S&P U.S. Issued High Yield Corporate Bond Index. As of Dec. 12, 2014, the index is down 2.96% MTD and has only returned 1.04% YTD. The current YTD return is a far cry from the 5.7% YTD return it had achieved at the end of August 2014. Energy bonds have been a big drag on the index, as the sector is 15% of the index’s weight. As of Dec. 12, 2014, the industry sector is down 8.65% MTD and down 9.52% YTD, while excluding energy, the index is down slightly on the month at -1.93% and up 3.21% YTD (see Exhibit 1).

After positive returns for October and November, the S&P/LSTA U.S. Leveraged Loan 100 Index, like the high-yield index, has been knocked off track by recent events. The index is down 2.06% MTD and has only returned 0.35% YTD as of Dec. 12, 2014. At this point, the YTD return of 2.6% that was achieved in July is a distant memory.

Exhibit 1: S&P U.S. Issued High Yield Corporate Bond Index Performance

Source: S&P Dow Jones Indices LLC. Data as of Dec. 12, 2014. Leverage loan data as of Dec. 14, 2014. Charts and tables are provided for illustrative purposes. Past performance is no guarantee of future results.

The posts on this blog are opinions, not advice. Please read our Disclaimers.