This morning’s report on September Employment beat expectations and took the unemployment rate to 5.9%, the lowest in six years. Payrolls gained 248,000 jobs and the labor force rose by 317,000 people. The stock market responded with a better than 10 point jump in the S&P 500 at the open as the Dow added about 175 points in the first 45 minutes of trading.

As nice as the news is, the longer run prospects for the economy are mixed. Sustaining the 4%-plus GDP growth seen in the second quarter will be difficult. One way to project GDP growth is to look at the growth in the labor force and productivity. This analysis won’t catch quarter to quarter shifts or reflect each adjustment by the Fed; it will show the intermediate term prospects for the economy based on the supply side and potential GDP. In simple terms, GDP’s potential depends on how many people are working and how much they produce. If the number of workers grows by half a percent annually and productivity (output per person) at one percent per year, GDP potential growth is the sum: one-and-one-half percent. While the economy can grow faster when it is recovering from a slump, as it did in the second quarter, it can’t sustain a pace above the potential growth over the long run.

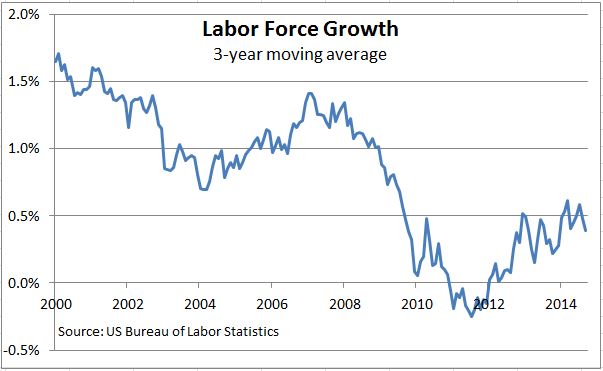

Currently the labor and productivity numbers aren’t encouraging. Labor force growth in the three years ended in September was 0.4% annually. The first chart shows the figures (three year moving averages) since 2000. With population growth at 0.9% and the population aging, labor force growth isn’t likely to get much above 0.5% — and that’s assuming that the unemployment rate stays under 6% and some discouraged workers return to the job market.

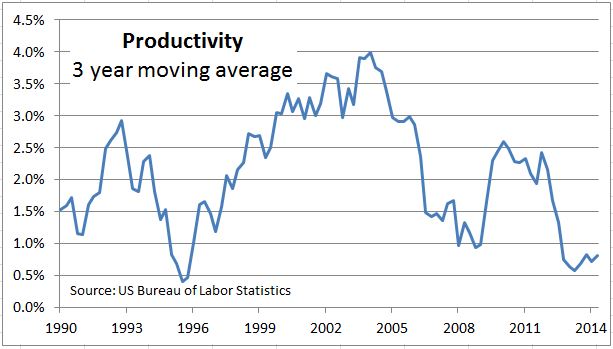

Productivity growth isn’t encouraging either. In the three years through the 2014 second quarter it grew 0.8%. The second chart shows this series since 1990. Productivity was strong during the tech boom in the 1990s, fell from its 2004 peak at 4% and enjoyed a short rebound in 2010-2011. An optimistic guess from the future is 1.5% or possibly 2%. Combine that with labor force growth and the US economy long run growth might be a bit better than 2%.

Two percent growth with interruptions for geopolitical crises, Fed tightening and other surprises is a challenge for investors. In a low to moderate growth environment, inflation, interest rates, dividend yields and other returns will remain low. Equity markets and corporate profits may benefit from smaller cost increases, but a strong rebound wages and incomes will be difficult. The boost in asset prices engineered by the Fed with low interest and discount rates is largely behind us. One challenge to investors will be to keep the expenses and costs of investments as low as possible so they take home as much of smaller returns they earn as they can. No wonder we are seeing reports about the strong growth of index-based investment approaches.

The posts on this blog are opinions, not advice. Please read our Disclaimers.