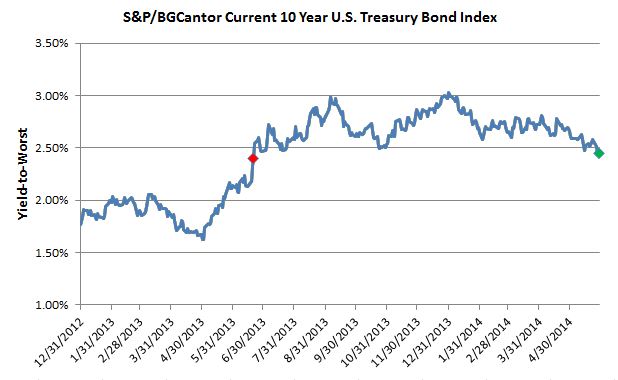

The month of May closed on a high note for bonds as the drop in yields saw the S&P/BGCantor Current 10 Year U.S. Treasury Index closed at a yield of 2.47%. Treasuries as measured by the S&P/BGCantor U.S. Treasury Bond Index returned 0.7% for the month and 2.12% year-to-date.

As of today, the yield on the 10-year is back up to 2.52% neighborhood after dipping down to 2.4%. Last week’s rally in all sovereign bonds is looking a bit reactionary to economic growth concerns both domestic and abroad. Focus remains on the monetary stimulus expected by the European Central Bank this week as global central banking activity has been very accommodative and does not appear to be changing any time soon.

The U.S. economic calendar for this week started today with ISM Manufacturing at 53.4 versus the expected 56.2 and ISM Prices Paid at 60 versus the expected 57. Construction Spending for April also came at a 0.2% which was expected to be at a 0.6%. Tomorrow’s Factory Orders (0.5%, expected) and Wednesday’s MBA Mortgage Applications (-1.2%, prior), along with ADP Employment Change (213k, exp.) and Nonfarm Productivity (-3%, exp.) will help fill in the picture. Thursday’s Initial Jobless Claims (310k, exp.) leading into Friday’s Change in Nonfarm Payrolls (215k, exp.) and the Unemployment Rate for May (6.4%, exp.) will be key determinants to the strength, or weakness, of the labor markets.

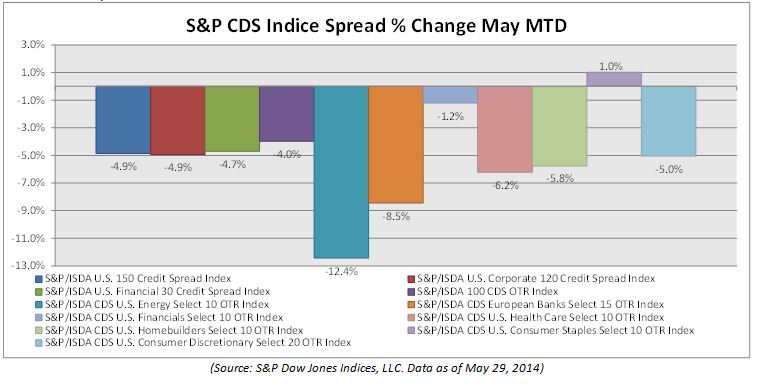

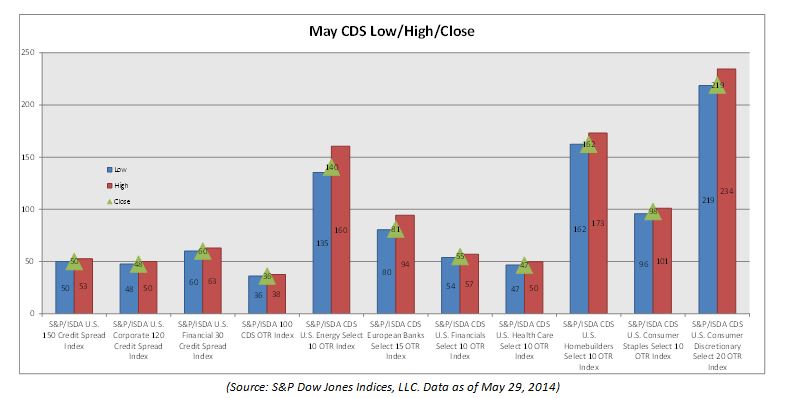

Investment grade corporates as measured by the S&P U.S. Issued Investment Grade Corporate Bond Index performed very well as the index returned 1.36% for the month and has returned 5.49% year-to-date. 2014’s return has been the best May year-to-date return since the 7.53% return of 2002.

Both the S&P U.S. Issued High Yield Corporate Bond Index and the S&P/LSTA U.S. Leveraged Loan 100 Index ended the month of May with total returns under 1%. The indices returned 0.99% and 0.76% respectively month-to-date. Numerous new high yield issues continued to come to market in names such as Audatex North America Inc., Baytex Energy, Cedar Fair, Interface Master Holdings Inc. and Precision Drilling. Year-to-date the S&P U.S. Issued High Yield Corporate Bond Index has returned 4.69% while loans is lagging behind returning 1.91%.

Last week the S&P U.S. Preferred Stock Index (TR) returned 0.73% for the week adding to the month-to-date return of 1.36% and topping out at a year-to-date return of 10.40% for the month. Comparing this hybrid bond/equity product to the S&P 500, the performance outshines the equity index which returned 2.35% for May and 4.97% year-to-date on a total rate of return basis.

Source: S&P Dow Jones Indices, Data as of 5/30/2014, Leveraged Loan data as of 5/31/2014.

The posts on this blog are opinions, not advice. Please read our Disclaimers.