Investor’s search for yield continued at the very start of last week’s heavy economic calendar. The Retail Sales numbers continued the trend of lower yields as the number released (0.1%) was weaker than the 0.4% surveyed. The news started a process of investor reassessment of economic growth expectations not only domestically but globally.

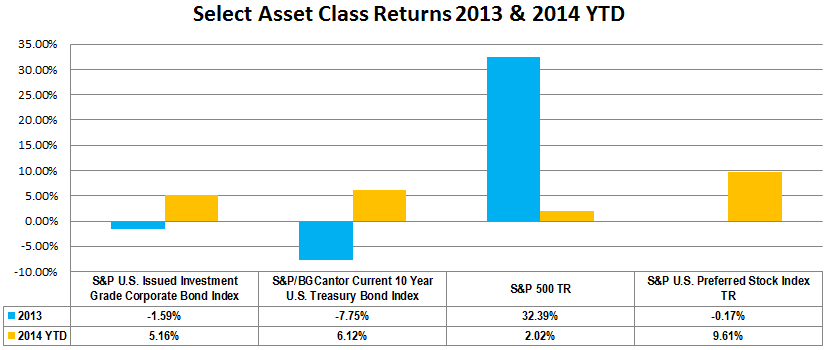

Year-to-date the yield of the 10-year as measured by the S&P/BGCantor Current 10 Year U.S. Treasury Bond Index is 51 basis points lower closing on Friday at a 2.52%. To date the rise in interest rates has not materialized as has been expected. As a result, performance in longer maturity indices has been strong as seen by the year-to-date total return of the S&P/BGCantor 20+ Year U.S. Treasury Bond Index which is 13.2%.

This week the calendar is light as the U.S. heads into a holiday weekend. Wednesday will be the first release of the week as MBA Mortgage Applications for May 16th will be released along with the minutes from the FOMC meeting of April 29th and 30th. Initial Jobless Claims (310K, expected), Existing Homes Sales for April (4.69M, exp.) and the conference Board U.S. Leading Index (0.4%, exp.) will follow on Thursday. Friday morning’s New Home Sales (425K) release will close out the week as the April surveyed number is expected to be stronger than March’s 384K.

The recent mediocre economy and current earnings expectations is reflected in the performance of the S&P 500’s whose total return year-to-date is presently 2.4%. Continued equity underperformance could keep bond yields lower in the near term continuing the demand for the steady income streams of fixed income products. Comparing equity returns to the hybrid product of preferreds, which contain components of both equity and debt, the hybrids are returning 9.74% year-to-date as measured by the S&P U.S. Preferred Stock Index.

The continued demand for higher yields can also be seen in the high yield and senior loan markets. The yield-to-worst of the S&P U.S. Issued High Yield Corporate Bond Index on the year is 42 basis points lower and currently at a 4.97%. Recent demand has been so popular that there is much discussion as to whether these markets are trading “rich” or overvalued. The total rates of return performance for both the S&P U.S. Issued High Yield Corporate Bond Index and the S&P/LSTA U.S. Leveraged Loan 100 Index on the month are in step at a 0.57% and 0.60% respectively. Year-to-date these indices do differ, 4.25% for high yield versus 1.75% for senior loans. Senior Loans have had small but steady increases to date while high yield’s strong February performance (1.92%) has carried the other months.

Activity in the new issue investment grade market has increased along with the lower interest rates. Multiple maturity deals issued in the primary market by names such as Pfizer, General Electric, Prudential Financial, Toyota Motor Credit, Volkswagen and more have added to investment grade issuance totals. A number of the fixed rate deals should find their way into the S&P U.S. Issued Investment Grade Corporate Bond Index. The index has returned 0.97% month-to-date and 5.08% on the year.

Source: S&P Dow Jones Indices, Data as of 5/16/2014, Leveraged Loan data as of 5/18/2014.

The posts on this blog are opinions, not advice. Please read our Disclaimers.