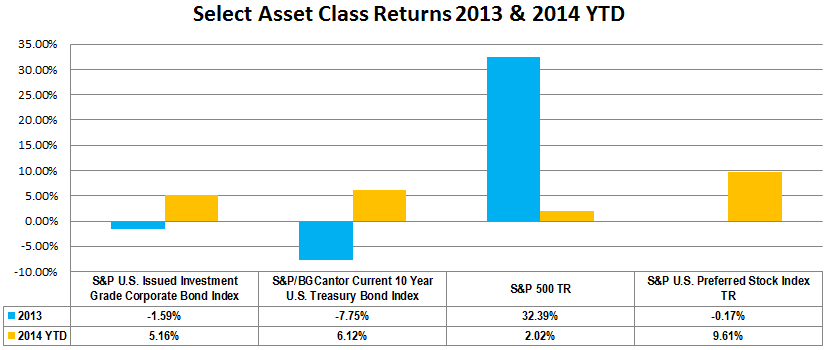

The U.S. preferred stock market is exhibiting the qualities of the hybrid equity / bond like structure they are. Through May 15th, 2014, the S&P U.S. Preferred Stock Index has recorded a year to date total return of 9.61% mirroring more the bond market than the stock market in this low rate environment. The index is heavily weighted in the financials sector, a sector that has seen a resurgence. The May 16, 2014 Wall Street Journal article entitled Higher-Yielding Bank Debt Draws Interest highlights the appetite for higher yields including subordinated debt and preferred stock. The bond like characteristics of preferred stocks seems to be rewarding investors so far in 2014.