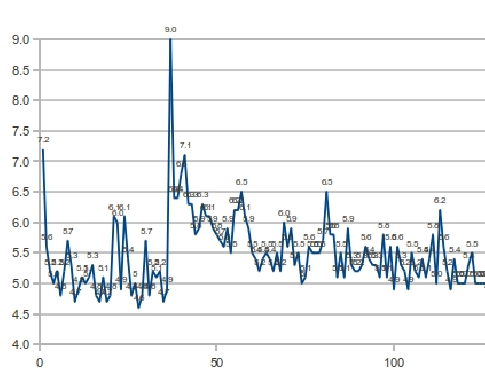

An article published Friday in Healthcare Payer News, “How health inflation could slow, or rise, in 2014” indicates a projected 6.5% increase in the large employer medical inflation for 2014 by PWC Health. As can be seen by the S&P Healthcare Claims Indices, an index series comprised of claims data provided by leading insurers in the US market, inflationary costs for large group medical claims fell from over 8% increase year over year in 2008 to about 4% from 2009 through the end of 2010, before dipping again to just under 3% in 2011 and 2012. For the ASO market, which comprises significantly more lives than Large Group, cost increases fell from 9% to roughly 5%, before dipping to just above 4% in 2011. An increase to 6% would represent a significant uptick in cost expenditures for the large employer market. The article goes on to talk about a growth rate of 4.5% after plan design changes, which take into account modifications to deductibles and other plan design features. The S&P indices, which were created in partnership and consultation with Aon Hewitt and Milliman consulting, are designed to look at overall costs of healthcare, and do not take into account plan design, which can be different from insurer to insurer. The same trends shown in the chart are also available from S&P for geographic regions, including census division, region, states, and major metropolitan areas.