As mentioned in my last post, logistics and technology are the two key factors in propelling commodities from local markets to global markets. The U.S. is now expected to be the biggest producer of natural gas in 2013, so what does that mean for the residents? Will gas bills be cheaper? Will there be a growth of U.S. natural gas into a global commodity?

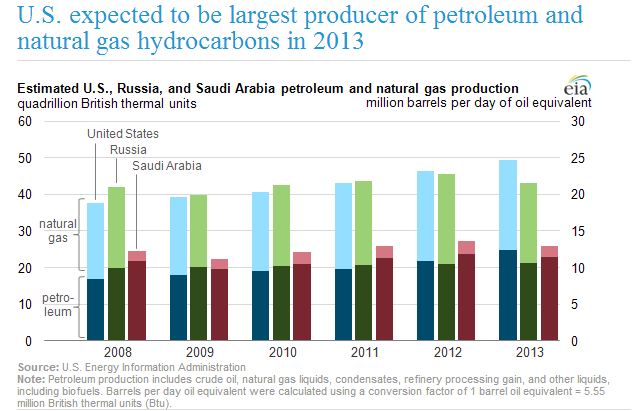

The U.S. Energy Information Administration (EIA) showed the following graph in a recent report:

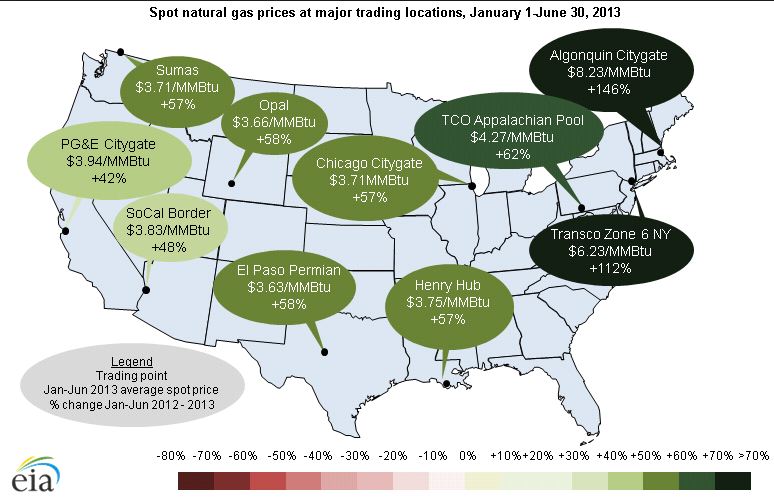

Although the U.S. natural gas production is set to surpass Russia and Saudi Arabia, natural gas is one of the most difficult and expensive commodities to store and transport. Below is a map that shows the production across the U.S. where the Northeast has had tremendous growth.

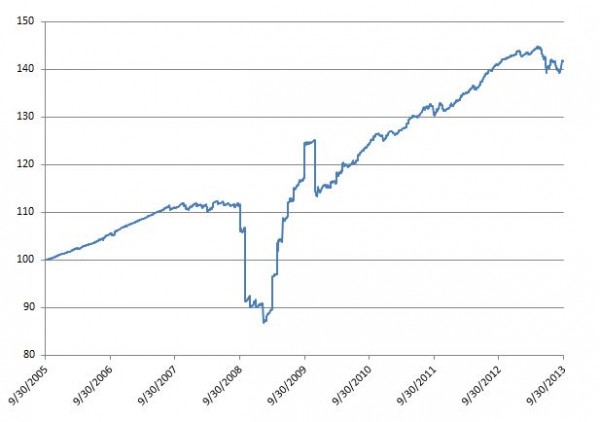

From these 10 major locations, the challenge is to store and transport the gas. One way to see this through indexing is to look at the negative roll yield by subtracting the price return index from the excess return version. Notice two things in the chart below are that there has not been a significant positive roll yield since Feb 2003 and that there is a recurring high seasonal cost around this time of year.

Also notice how high on average the roll costs are in Sept-Oct versus the rest of the year and that Oct 2013 has the lowest Oct roll cost since 2005.

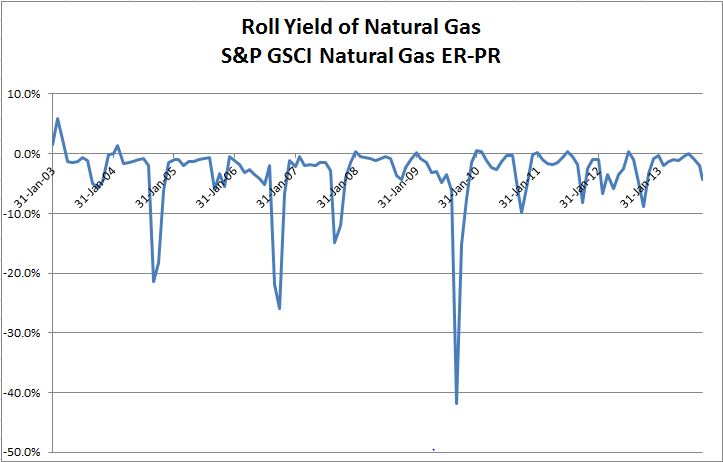

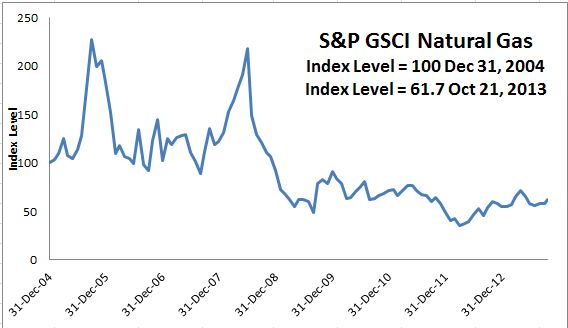

With that, the S&P GSCI Spot Index Level is down to 61.7 from a starting point of 100 on Dec 31, 2002.

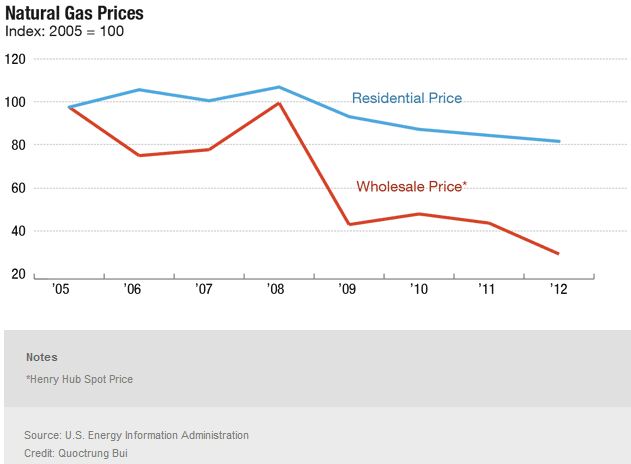

Which as a general measure of the market, falls in between the residential and wholesale prices shown below.

Why do the wholesalers get the cheaper price but consumer like you and me have to pay? As Quoctrung Bui points out in his article, a big chunk of our gas bill is the cost of building and maintaining pipes. Just the mechanism that Gary Morsches discussed in his interview. Those costs don’t go down when natural gas prices fall, so the prices consumers pay for gas haven’t fallen nearly as much as the wholesale price for gas.

Last, the question of whether U.S. natural gas can grow into a global commodity might depend on where the heaviest investment is spent. Many companies that produce goods out of natural gas are eagerly building facilities to take advantage of low prices, but that will cut into inventory and eventually drive prices up again if production can’t keep up with demand. Also, there are a few countries with larger natural gas reserves than in the U.S. –

and if they invest more heavily in exploration and production – or technology as Gary puts it, than in logistics (China announced $13 billion in planned spending for E&P), then the chance U.S. natural gas becomes global is less likely. Earlier in the year there was news of a U.K. company signing a deal to bring U.S. natural gas to U.K. homes, which may help the U.S. natural gas globalization, but then the real question may be how long it will last.

The posts on this blog are opinions, not advice. Please read our Disclaimers.