August was not the best of months in the stock market: the S&P 500 lost 3.1% and the Dow lost 4.4%. This leaves investors wondering what’s next?

The stock market bounces up and down more often with more amplitude and less method to its madness than the rest of the economy. If one could get past the noise in the market, there should be a financial measure of the economy’s value – an indicator that based on the financial data of the stock market and the value of the economy. Tobin’s Q does this; it is the ratio of the market value of stocks to the replacement cost of their assets. It was developed by James Tobin, a Nobel laureate economist some 25 years ago. If one could buy all the assets of all the companies in the market for less than the market value of those companies, the companies would be over-valued and Tobin’s Q would be greater than one. If the reverse – the cost of buying the assets of all the companies is greater than the market value – is the case, the market is under-valued. From time to time, the stock market value of an oil company seems to lose any connection to the value of the company’s oil reserves. If an oil company’s reserves are worth $30 billion while its market value is $10 billion, some analyst will suggest “drilling for oil on Wall Street” and Tobin’s Q for the company, assuming the only asset were the reserves, would be one-third.

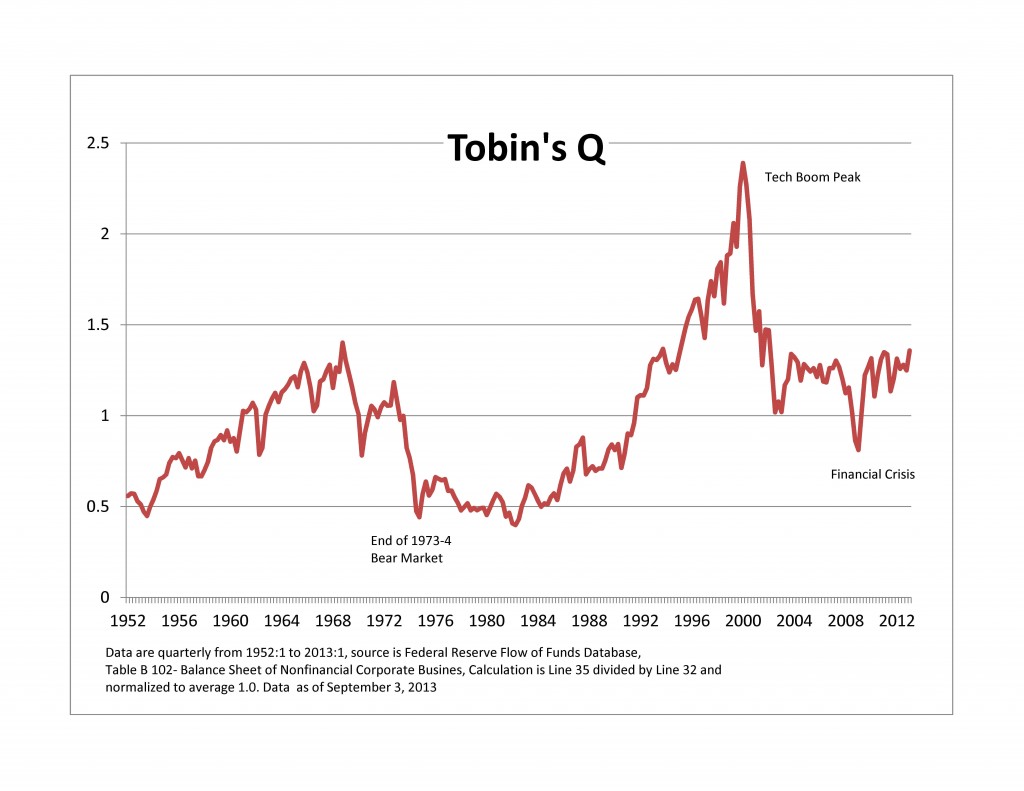

We can calculate Tobin’s Q for nonfinancial corporations in the US using data from the Federal Reserve’s Flow of Funds (FOF) database. The FOF includes a consolidated balance sheet which shows both historic and replacement cost series and the market value of equities. While the average level of Q over a very long time period should be one if the data are comprehensive, the average from 1952 to the first quarter of 2013 is a bit less at 0.74.

To make the chart easier to interpret, the series is normalized to average one over the entire time period. The chart shows the three times since the 1950s when the S&P 500 lost about half of its value – 1973-4 Bear market, the aftermath of the Tech Boom and the financial crisis. Tobin’s Q warned about each of those. As of the first quarter of this year, Q was moving higher. It is nowhere near as high as it was when the Tech stocks peaked, but it is back at levels seen before the financial crisis.

Tobin’s Q is not the only market signal attracting attention. The Financial Times wrote a long piece about CAPE – the cyclically adjusted P/E ratio developed by Robert Shiller, one of the developers of the S&P/Case-Shiller Home Price Indices. As the FT notes, there is a lot of debate about what CAPE is signaling. The paper also compares CAPE and Q.

The posts on this blog are opinions, not advice. Please read our Disclaimers.