Since its inception a decade ago, ETFs’ in India have clocked significant growth. The number of ETFs’ and ETP listed has grown to 37 and are spread across Gold and Equity with a single money market ETF. While the assets are currently at $2bn, there are changes afoot which will see the ETF business undergo an important transformation over the next few years. A noteworthy change was the reduction in the Securities Transaction Tax (STT) for designated equity investments from 10 bps to 1 bp which reduced creation/ redemption/ trading costs and resulted in narrower spreads.

Retail Investment

In the past few years, Reserve Bank of India* and the SEBI*, have taken an initiative to promulgate an RDR-style regulation along with the advent of a commission free – direct share class (known as a ‘direct plan’). The regulation (SEBI Advisor Regulation) mandates registration of all intermediaries as either distributors (where they get paid by the manufacturer for distribution) or advisors (paid by clients for advice). For such advisors, ETFs’ make ideal building blocks for designing and managing investment pools including optimized asset allocation strategies to more sophisticated target date portfolios. The low cost ensures the returns are better and the transparency improves ex-ante risk management. An ETF based portfolio, therefore, becomes an attractive option for advisors who wish to efficiently manage client portfolios and charge an advisory fee (to offset revenue shortfall as a result of said advisory regulation).

Additionally, the government has introduced ISA (UK) /401K (US) type tax incentives which give retail investors a tax break on ETF investments. While the scheme is clearly targeted at attracting long term money to equity markets, it has the potential to introduce a hereto untapped segment.

Institutional Market Developments

At the moment, all insurance and pension funds are managed in house and list of eligible securities is small. For all such funds, additional restrictions apply including limiting 1.5% of the portfolio for mutual fund investments (including ETF) and a prohibition on investing in parent company shares. This prevents fund managers access to inexpensive beta exposures and even manager selection. Proposed changes to the Insurance and Pension Fund (and Mutual Fund regulations) regulation envisages allowing all three categories to invest into ETFs’. This would open up a $400 bn growing market for ETF manufacturers. While domestic ETF cater to the demand for wider market exposure and as elements in quantitative strategies, foreign ETFs’ will be required to diversify portfolios.

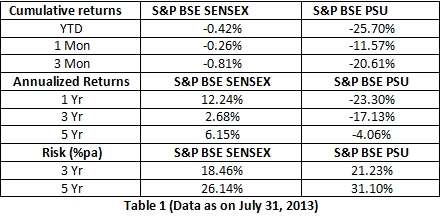

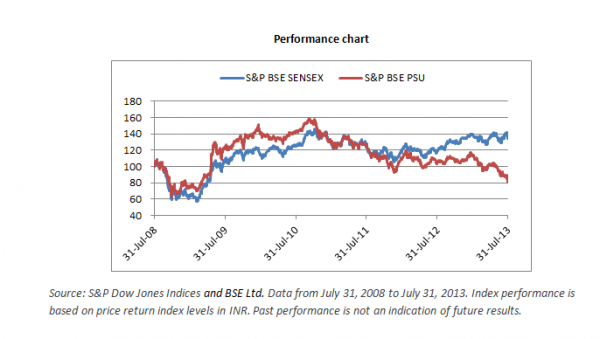

Given these changes and the launch of the government promoted Central Public Sector Enterprise (CPSE) ETF one can expect to see a proliferation of both domestic and foreign ETFs’.

*Note:

Reserve Bank of India regulates the bond and money markets (and consequently, banks)

Securities and Exchanges Board of India regulates the capital markets

Insurance Regulatory and Development Authority regulates Insurance Companies and Funds

Pension Fund Regulatory and Development Authority regulates all government and private pension funds

Forward Markets Commission regulates all commodity markets

S&P Dow Jones Indices is an independent third party provider of investable indices. We do not sponsor, endorse, sell or promote any investment fund or other vehicle that is offered by third parties. The views and opinions of any third party contributor are his/her own and may not necessarily represent the views or opinions of S&P Dow Jones Indices or any of its affiliates.

The posts on this blog are opinions, not advice. Please read our Disclaimers.