My colleague, David Blitzer, is discussing index construction in his blog series “Inside the S&P 500”, and so far has reviewed selecting stocks and the float adjustment. While the index construction principles of transparency, liquidity, and systematic rules-based methodologies are widely similar between equities, commodities and other asset classes, there are details that distinguish the asset classes. For example, market capitalization and style like growth or value may be associated with equities while credit quality and duration may be linked with bonds. The main features of commodity indices are weightings, rolls, and regions.

Since 2007, there have been a number of new commodity indices created to modify the first-generation flagships, the S&P GSCI and DJ-UBS, intended to improve the returns and reduce risk. However, as my colleague, Craig Lazzara, points out, newer developments to flagship indices don’t necessarily create smart beta so he prefers the term “alternative beta, because calling it smart beta implies the beta you get from the S&P 500 (or flagship) is dumb”.

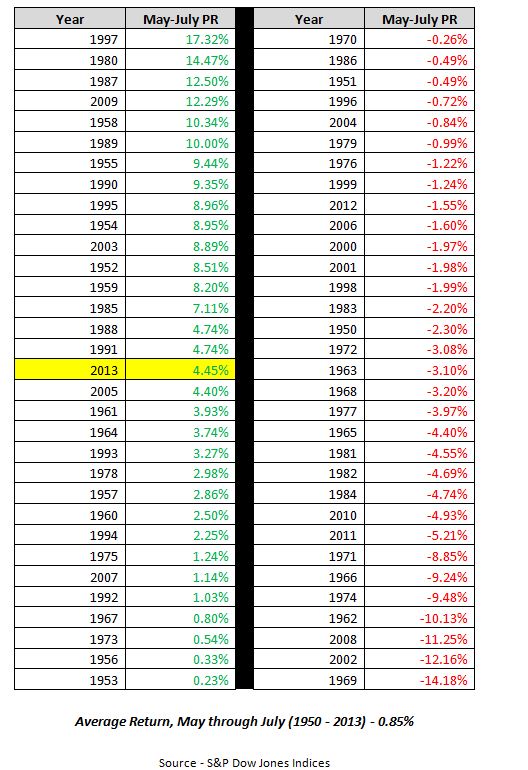

He couldn’t have stated that concept any better for commodities. The S&P GSCI and DJ-UBS have been criticized for their basic strategy of holding the most liquid front-month contracts that lose from negative roll yield when exiting the expiring contract and entering the new contract every month when the later-dated contract is more expensive, or in contango. The blame comes from investors who were allocating to commodities in the time period between 2005 and 2011 when contango was the prevailing condition in 93% of months. For them, alternative beta that modified rolls or weights may have seemed to be the smarter solution since backwardation was a thing of the past. However, today that wisdom may not hold true because while the persistence of backwardation hasn’t been seen since prior to 2005, backwardation (as measured by the difference between the excess return and price return versions of the S&P GSCI), appeared in 5 months in 2012 an has now continued this year since May.

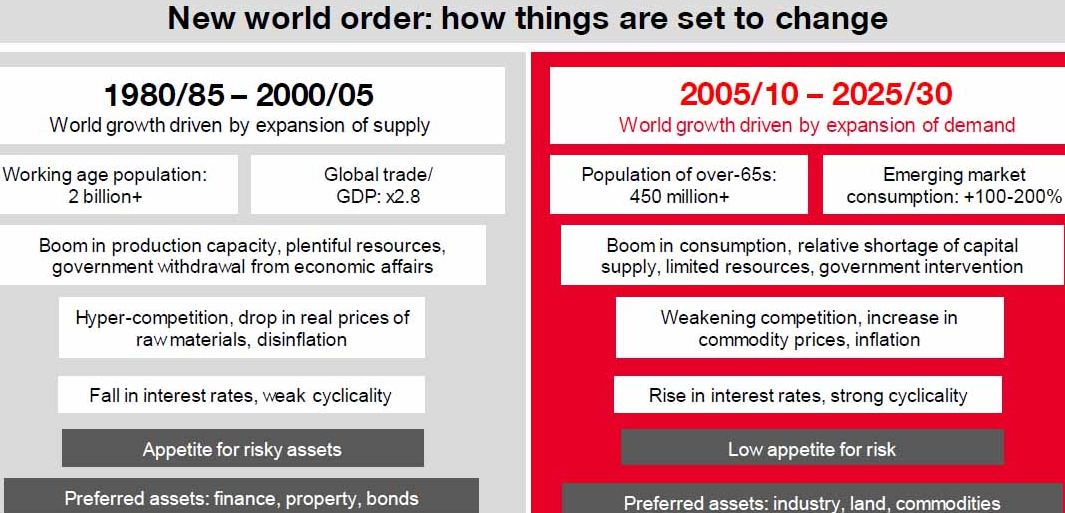

There is a noticeable shift of world growth that may be causing backwardation to reappear. A number of characteristics of world growth driven by expansion of demand are becoming more widespread by the move from world growth driven by expansion of supply. These factors are getting stronger since last year and they may drive the frequency and magnitude of cycles higher that may increase the incidence of switching between contango and backwardation.

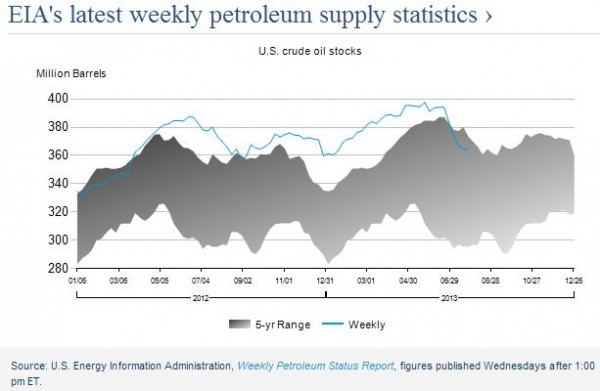

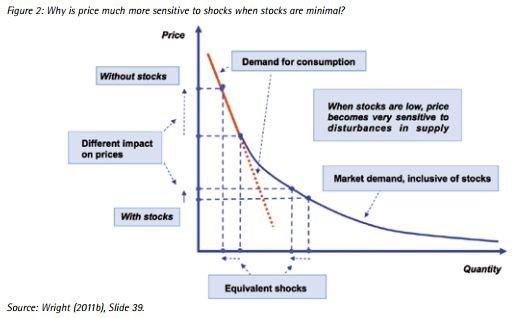

Also from this shift, the inventories are lower so commodities have been more sensitive to supply shocks than they have been in the past as evidenced by the moves in gold, livestock, and energy. Given that price shocks are differentiating factors between commodities, for example, a drought may affect corn but not gold or a pipeline burst may drive oil but not sugar, there should be more focus on fundamentals. This is important since diversification may start to overcome the risk-on/risk off environment as discussed in a paper by Hilary Till, EDHEC-Risk Institute. (she will also discuss this in her keynote at our upcoming commodity seminar)

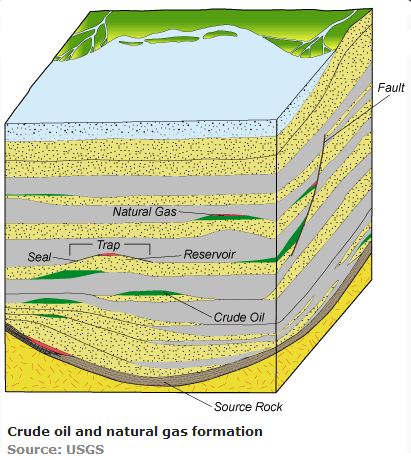

In the possible divergence of individual commodity performance, one component to watch is petroleum since the oil term structures are sensitive from the challenging storage situations. The global impact of the U.S. shale energy boom may be a significant force in shaping the return opportunities ahead just as the increased pipeline capacity has been supporting the S&P GSCI Crude Oil (WTI) and S&P GSCI Unleaded Gasoline. The environment may have a large positive index impact from backwardation, particularly in the S&P GSCI with its relatively heavy energy weight. If this is the case, the index rehab that intended to upgrade the basics may have gone out of style – at least for now.

The posts on this blog are opinions, not advice. Please read our Disclaimers.