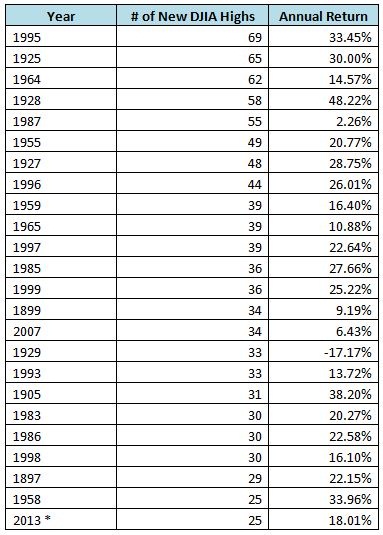

The number 25. Christmas Day. The atomic number of manganese. The jersey number typically reserved for a baseball team’s best slugger. And to date in 2013, the number of new highs hit by the Dow Jones Industrial Average. Year to date through Friday (July 12) the Dow, ending the session at 15,464.30, has closed at a new high 25 times. How does this compare to years past? Well, it’s a pretty active pace – the DJIA is up over 18% on the year – but still a ways off the record. In the 118 years since the DJIA’s inception, the most active year for new highs was 1995 when the DJIA hit a record close 69 times. 2007, in the lead up to the great recession, is on the list with 34 new highs. With about 5 ½ months left to go – and with no apparent end to the Fed’s QE actions – 2013 currently ranks 24th on the list. Keen observers of the list below will also note some other significant numbers: 1929 and 1987, years associated with historic equity market declines.

Source: S&P Dow Jones Indices. Data is through July 12, 2013.

The posts on this blog are opinions, not advice. Please read our Disclaimers.