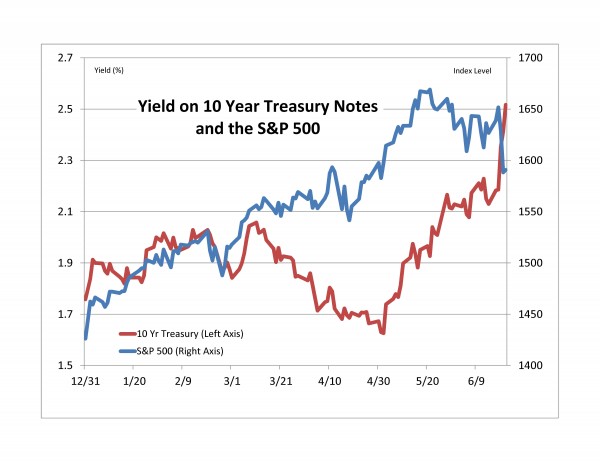

Friday afternoon and the markets survived the Fed’s pre-announcement of QE3’s demise. The big move was in the yield on 10 year treasuries, now about 2.5%, the highest since August of 2011. VIX broke through 20 the first time this year. The stock market is down but has only retraced its steps back to late April or early May.

Consensus outlook for the Fed is reductions in QE3 bond buying beginning in the fall and the complete end to QE3 sometime next summer. Interest rates are expected to rise, but there is little agreement as to how much. The Fed’s upbeat forecast for the economy of 3%-3.5% GDP growth in 2014 with continued low inflation is seen as a bit optimistic.

And now…

First, just because the Fed chairman Bernanke spent Wednesday afternoon explaining what the Fed expects and what it is likely to do, don’t believe it is locked-in or committed to a time table. The Fed can, and frequently does, change its plans if the economy and markets change. One line many economists attribute to John Maynard Keynes is, “when the data change, I change my mind; what do you do?” Whether or not the Fed economists are Keynesians, they do change their minds when the data change.

Second, if the Fed’s forecast turns out to be right – stronger growth, no inflation and less unemployment – the stock market’s prospects should look a whole lot better than in the last few days. The market can advance when interest rates are rising, especially of the cause of rising rates is faster economic growth.

Third, not only is the rest of the world watching, and worrying, about the Fed; the Fed is also watching the rest of the world. One wild card may be China where there are lots of signs that economic growth is slowing and short term interest rates spiked earlier this week. Were Chinese economic growth to falter we would hear renewed concerns about the economy and speculation about continued quantitative easing.

Source: Data for the chart are daily data from 12/31/2012 to 6/21/2013 as of 6/21/2013. 10-year Treasury yield is from Bloomberg, S&P 500 is from S&P Dow Jones Indices. Past Performance is no guarantee of future results.

The posts on this blog are opinions, not advice. Please read our Disclaimers.